M&A Advisory Services

Entrepreneurship Through Acquisition (ETA)

Your Path to Entrepreneurship Starts Here

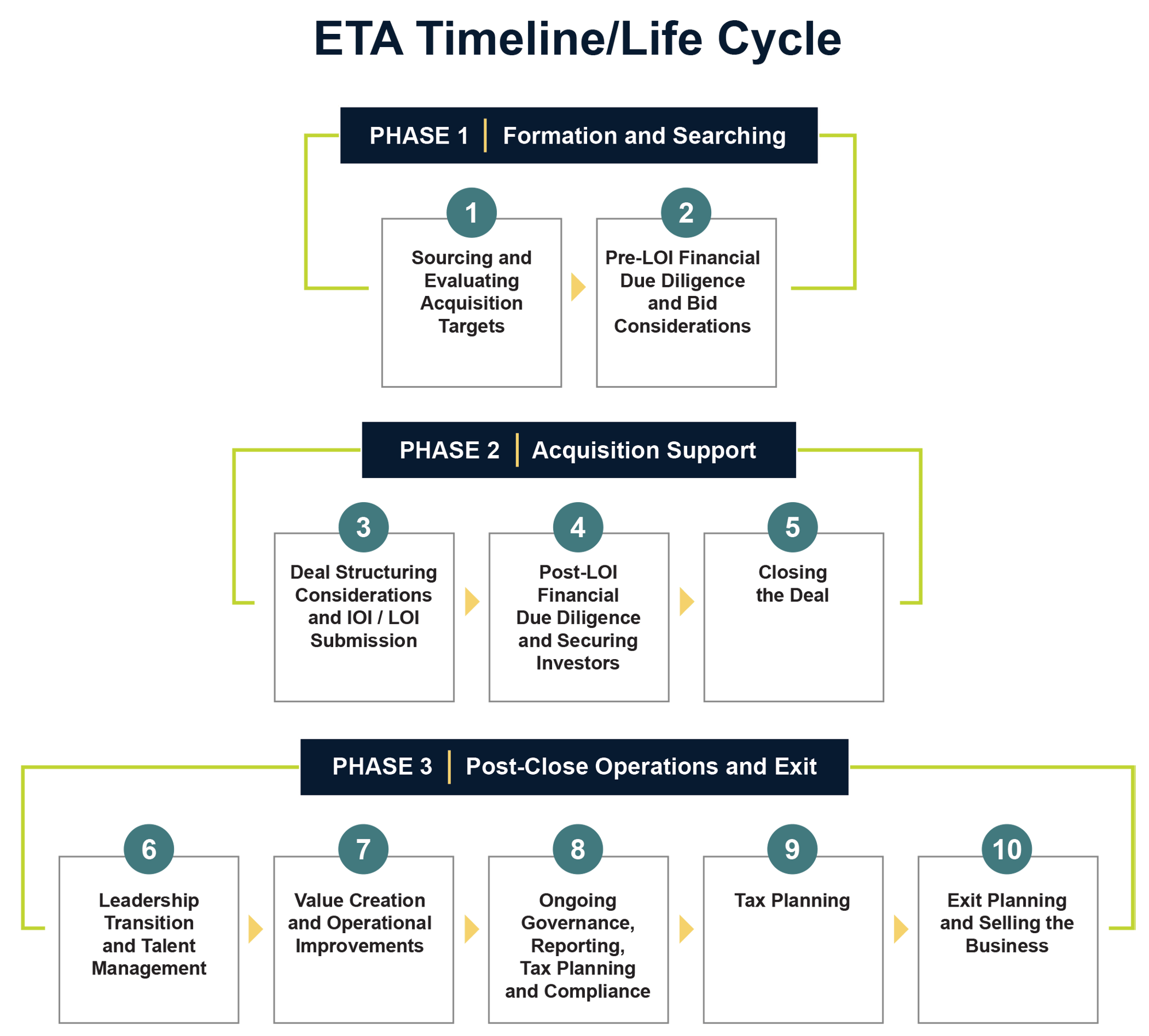

Buying and leading a business is one of the most rewarding ways to become an entrepreneur. At Redpath and Company, we guide search fund entrepreneurs through every stage of that journey, from identifying acquisition opportunities to closing the deal and setting up post-acquisition success.

We know the ETA process is complex, fast-moving, and full of critical financial decisions. Our team helps you move forward with clarity, confidence, and expert guidance at every step, seamlessly transitioning from financial diligence into outsourced accounting, assurance, and tax services — all under one roof.

What We Do

Our Search Fund Advisory team supports ETA entrepreneurs through the entire lifecycle of the search and acquisition process. We combine deep M&A experience with hands-on, responsive service so you can make informed, strategic decisions without getting lost in the details.

We help you:

- Assess acquisition targets and financial statements

- Perform quality of earnings and working capital analysis

- Optimize tax structure and org structure

- Structure deal terms, debt, and equity financing

- Model post-acquisition scenarios and growth projections

- Prepare for closing, integration, and early operational success

Whether you’re early in your search or deep into diligence, you’ll have a proactive partner who understands the ETA model and what it takes to succeed as a first-time buyer.

From Search to Success

Every successful ETA entrepreneur needs a trusted partner — not just a service provider. Redpath brings both technical precision and relational partnership to help you move from aspiration to acquisition to acceleration.

Our role doesn’t end at closing. Once the deal is done, we continue to support your growth through financial reporting, tax strategy, and long-term advisory services that strengthen your foundation as a business owner.

You don’t have to navigate this alone. With Redpath, you gain an experienced team that's seen hundreds of transactions and knows how to help you make yours successful.

Let us help guide:

Formation & Searching

Our team provides hands-on education and strategic guidance, ensuring you understand each step of the search and acquisition process. From structuring your fund to evaluating targets, we empower you to make informed decisions with confidence.

-

Quick-Hit Assessments

-

Financial Modeling & Valuation

-

Search Strategy & Execution

Acquisition Support

We provide expert diligence and planning that aligns with your M&A strategy, identifies risks early, and ensures a smooth acquisition to set the stage for post-close success.

- Transaction Management

- Tax Structuring

- Financial Diligence

- Operational & IT Diligence

- Closing Advisory

Post-Close Operations & Exit

We help execute key First 100 Days initiatives to build a strong foundation for growth, synergy, and long-term value, driving a successful exit.

- Operational & Organizational Design

- Financial Planning & Strategy

- Strategic Tax & Compliance

- Change & Communications Management

- Assurance & Risk Management

- Accounting & Bookkeeping Support

- Valuation Support

- Sell-Side Quality of Earnings

Why Entrepreneurs Choose Redpath

Entrepreneurship through acquisition is different — and so is our approach. Redpath combines transaction advisory expertise with real-world business insight, helping you move quickly while avoiding costly missteps.

End-to-End Search Fund Expertise

Redpath's experienced search fund experts will guide you through every phase of the process, from initial strategy and formation to acquisition and post-transaction operations.

Hands-On Guidance & Education

We prioritize education, keeping you informed at every step so you can make empowered decisions with confidence.

Nimble & Economical Approach

Our nimble approach streamlines due diligence and deal structuring, identifying potential risks early and addressing them proactively.

Dedicated Client Managers

A single point of contact manages your entire process, ensuring seamless internal collaboration and consistent support throughout your journey.

We provide:

- Clarity through complexity: We make the numbers make sense, translating diligence and deal structure into clear, actionable decisions.

- Speed and responsiveness: Deals move fast. Our team stays ahead of deadlines, delivering accurate analysis and guidance when you need it most.

- Strategic foresight: We think beyond the transaction — helping you plan for ownership, operations, and long-term value creation.

- A single point of contact: With Redpath, you’ll never wonder who to call. You’ll have one dedicated client manager backed by specialists in tax, assurance, and advisory.

Start Your ETA Journey with Confidence

If you’re a search fund entrepreneur or MBA graduate ready to acquire and lead a business, Redpath can help you get there — faster, smarter, and with greater clarity.

Let’s start a conversation.

Buying a Business

Deal strategy must be linked to thorough due diligence to successfully close and realize the full value of your new asset. Our cross-department structure offers private equity and other buyers full transaction support, helping you reduce risk and identify opportunities.

Creative Deal Structuring for Independent Searchers: Balancing Price, Risk, and Growth

For independent searchers, structuring the right deal isn’t just about finding a great business. It’s about creating the right balance...

Read More

The Hidden Value of a QoE: Better Diligence, Better Audits

For searchers, a Quality of Earnings (QoE) engagement does more than support a transaction. It sets the foundation for smoother...

Read More

Balancing Pre-LOI and Post-LOI Diligence in ETA: Strategy, Tradeoffs, and Winning the Auction

Entrepreneurship through acquisition (ETA) offers an increasingly popular path to business ownership. For many, it’s an appealing alternative to starting...

Read More

3 min read

Sourcing and Evaluating Acquisition Targets: Practical Insights for Search Fund Entrepreneurs

Nov 18, 2025 by Redpath and Company

Jeremy Miller, CPA, is a member of the transaction advisory services team at Redpath. He has supported clients on over 250 due diligence projects in a variety of industries, including healthcare, manufacturing and distribution, construction, life sciences, and consumer and industrial products. Jeremy helps identify key industry and deal risks through quality of earnings and revenue, net working capital, and debt and debt-like analyses for private equity and corporate clients. He has provided public accounting services since 2012 and joined Redpath in 2020.

Contact Jeremy:

Allison Hillman is a Director and leads the Client Accounting & Advisory Services team at Redpath and Company. Allison brings over a decade of diverse experience in finance, accounting and client management—leveraging an extensive background to deliver strategic financial insights and tailored accounting solutions to a wide range of clients.

Allison began her career with roles in both audit and tax for an international CPA and advisory firm, where she developed expertise in financial statement audits, tax preparation, and consulting for various industries including construction, real estate, and nonprofit. With subsequent roles at Lifetouch National School Studios as an Accounting Analyst and Finance Manager, she honed her skills in month-end close, budgeting, forecasting and performance analysis. During her tenure, Lifetouch transitioned from an employee stock ownership plan (ESOP) to merging with Shutterfly, thereby becoming a publicly traded company. The combined company was later acquired by private equity. Throughout these major transitions, Allison played a pivotal role in financial reporting, revenue forecasting, and adapting financial strategies to align with the company’s evolving ownership structure.

In her most recent position as Client Solutions Director at Robert Half, Allison built deep relationships with Accounting and Finance leaders, offering flexible consulting and staffing solutions that aligned with their strategic goals.

Allison holds an MBA from Keller Graduate School of Management and a Bachelor of Arts from Wellesley College, where she graduated with Cum Laude honors. She is also a Certified Public Accountant (inactive) in the state of Minnesota.

Allison’s unique combination of technical expertise, leadership, and relationship-building makes her a trusted partner for organizations looking to optimize their financial operations and achieve sustainable growth.

Contact Allison:

Joe Hellman, CPA, partner, leads the Transaction Advisory Services practice at Redpath and Company. He provides support to clients throughout the transaction life cycle, from evaluating opportunities pre-LOI to post-close net working capital true-ups and synergy assessments on both buy-side and sell-side transactions. Joe has experience assisting buy-side and sell-side transactions across a variety of industries, including manufacturing, healthcare, construction, consumer products, distribution, financial services, technology, and energy. He has provided public accounting services since 2008 and joined Redpath and Company in 2020.

Contact Joe:

John Kammerer, CPA, is a tax partner at Redpath and Company and holds a seat on the firm’s board of directors. He leads the firm’s business tax service area, assisting clients with tax planning and preparation, entity structuring, and M&A transactions. John works with a variety of clients in industries such as manufacturing, construction, real estate, and professional services. He is a frequent presenter on topics of business taxation and entity structuring. John is also a member of the S Corp Association advisory board and is actively involved with the group to promote and support tax policies that positively impact S Corporations and privately-held businesses. John graduated from Winona State University with a Bachelor of Science degree in Accounting. He is a member of the American Institute of Certified Public Accountants (AICPA) and the Minnesota Society of Certified Public Accountants (MNCPA). He has provided public accounting services at Redpath and Company since 2004.

Contact John: