Redpath Welcomes Mike Dunkle as a Transaction Advisory Services Partner

ST. PAUL, MN – February 3, 2026 – Redpath and Company is pleased to welcome Mike Dunkle as a Partner in the firm’s Transaction Advisory practice....

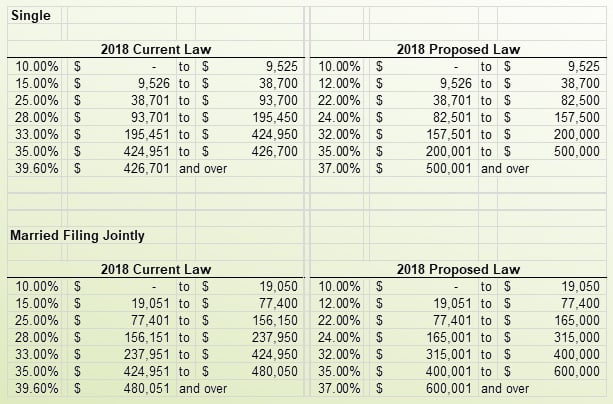

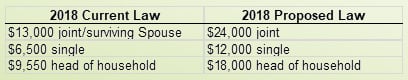

November 19, 2017 — On Friday, December 15, 2017, the Conference Committee released a reconciled version of the "Tax Cuts and Jobs Act". The House and Senate have since voted it into law.

Below is a summary of some of the major provisions of the bill.

ST. PAUL, MN – February 3, 2026 – Redpath and Company is pleased to welcome Mike Dunkle as a Partner in the firm’s Transaction Advisory practice....

The Redpath and Company BottomLine Newsletter ishere!

As 2025 drew to a close, the Governmental Accounting Standards Board (GASB) issued Statement No. 105, Subsequent Events. While the requirement to...