The Hidden Value of a QoE: Better Diligence, Better Audits

For searchers, a Quality of Earnings (QoE) engagement does more than support a transaction. It sets the foundation for smoother financial reporting...

1 min read

Redpath and Company

:

December 16, 2020

Redpath and Company

:

December 16, 2020

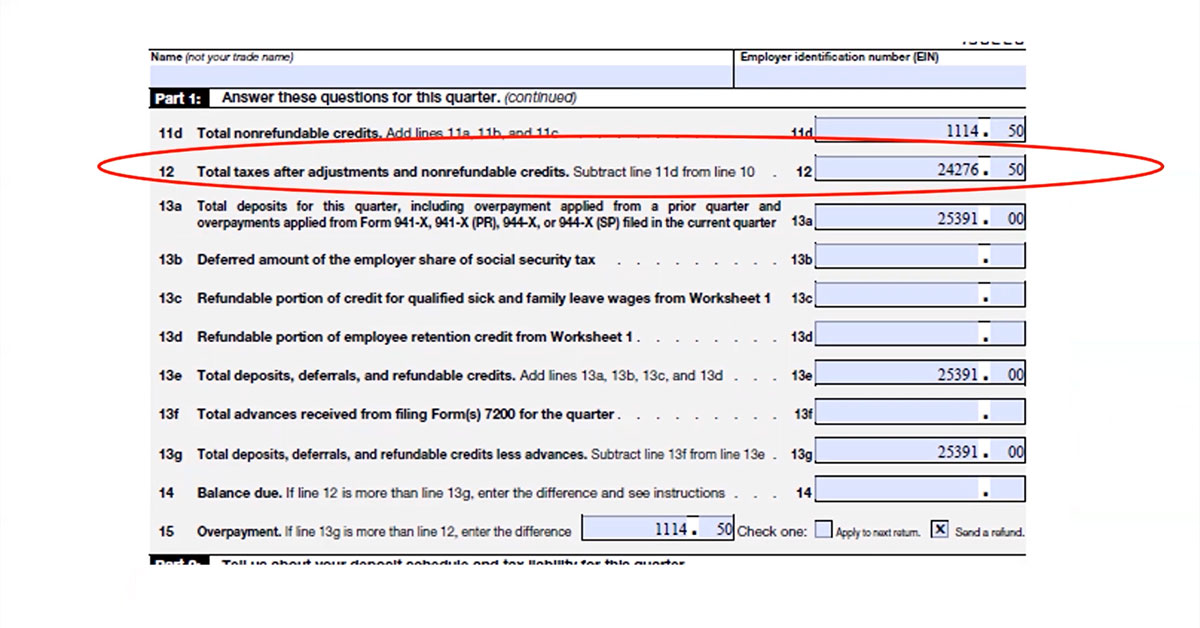

December 16, 2020 - The Families First Coronavirus Response Act (FFCRA), signed into law by President Trump in March 2020, requires certain employers to provide employees with paid sick leave and expanded family and medical leave for reasons related to COVID-19. The Act, administered by the U.S. Department of Labor, contains a provision for a payroll tax credit taken on IRS Form 941 by the employer.

The payroll tax credit, administered by the Internal Revenue Service, provides covered employers a dollar for dollar reimbursement for all qualifying wages paid under FFCRA, the portion of employer Medicare Tax paid on the qualifying wages and qualifying health insurance expense as it relates to the employee on leave. The three-part credit is applied against the employer’s payroll tax liability on Form 941.

In this video, Heather Larson, CPP provides an overview of why the FFCRA is relevant now and opportunities that you may have missed, including a review of areas to pay close attention to on Form 941 starting at two minutes and fifteen seconds. If you have further questions upon completing the video, we encourage you to reach out to your tax planning advisor for further assistance.

For searchers, a Quality of Earnings (QoE) engagement does more than support a transaction. It sets the foundation for smoother financial reporting...

In most M&A conversations, risk can be oversimplified too quickly. Buyers ask, “What if we overpay?” Sellers worry, “What if we leave money on the...

For independent searchers, structuring the right deal isn’t just about finding a great business. It’s about creating the right balance between risk...